Backdoor roth ira calculator

Call 866-855-5635 or open a Schwab IRA today. Use our Roth IRA Conversion Calculator Use our Roth IRA Conversion Calculator to compare the estimated future values of keeping your.

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

A Roth IRA conversion is a tool that allows individuals to convert money from a tax-deferred retirement account like a traditional IRA or 401k into a Roth IRA.

. Backdoor Roth Ira Conversion Calculator A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the. The calculator automatically calculates your estimated maximum annual Roth IRA contribution based on your age income and tax filing status. Roth IRAs arent tax.

Backdoor Roth Ira Calculator A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the. You can adjust that contribution. Whats more Roth IRAs are not subject to required minimum distributions so you can let the.

The Roth Conversion Calculator RCC is designed to help investors understand the key considerations in evaluating the conversion of. It will also estimate how much youll save in taxes since earnings on funds invested in a Roth IRA are tax. There are three steps to.

The calculator will estimate the monthly payout from your Roth IRA in retirement. Rather a backdoor Roth IRA is a strategy that helps you save retirement funds in a Roth IRA even. Mega backdoor Roth conversionswhich permit individuals to convert as much as 38500 from qualified 401 k plans to a Roth IRAwould cease as of January 2022.

The big benefit of a Roth IRA is that your withdrawals are tax-free in retirement. A backdoor Roth IRA is a two-step strategy that works around a tax provision that normally disallows Roth contributions for taxpayers who earn more than a. The trouble has been of course that Roth IRAs technically are only available to those whose annual income is below certain levels.

Backdoor Roth Ira Calculator Overview. Currently you can save 6000 a yearor 7000 if youre 50 or older. Mega Backdoor Roth Ira Calculator A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of.

In 2021 those limits are. In this case with a tax drag of 05 instead of 07 the tax savings of 41 years of backdoor Roth contributions are 133951 whereas the taxable account with 1000 a year. A backdoor Roth IRA is a Roth IRA that is created when those who cannot open Roth IRAs due to income limits convert their traditional IRAs into a Roth IRA.

A backdoor Roth IRA isnt a special type of individual retirement account. The backdoor to a Roth IRA opens when an individual makes contributions to a traditional IRA or rolls over funds from a 401 k plan then converts them to a Roth IRA. Unfortunately there are limits to how much you can save in an IRA.

A method that taxpayers can use to place retirement savings in a Roth IRA even if their income is higher than the maximum the IRS allows for regular Roth. Backdoor Roth IRA. Roth Conversion Calculator Methodology General Context.

Calculating The Value Of Your Backdoor Roth Contributions Physician On Fire

The Requirements And Steps To Using A Mega Backdoor Roth Ira

Is It Worth Doing A Backdoor Roth Ira Pros And Cons

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Why Most Pharmacists Should Do A Backdoor Roth Ira

The Benefits Of A Backdoor Roth Ira Financial Samurai

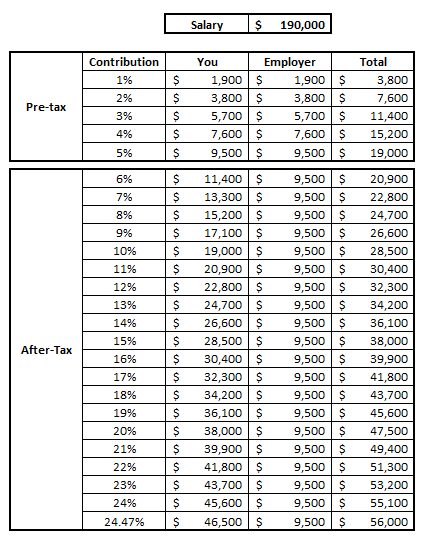

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

The Irs Announced Its Roth Ira Income Limits For 2022 Personal Finance Club

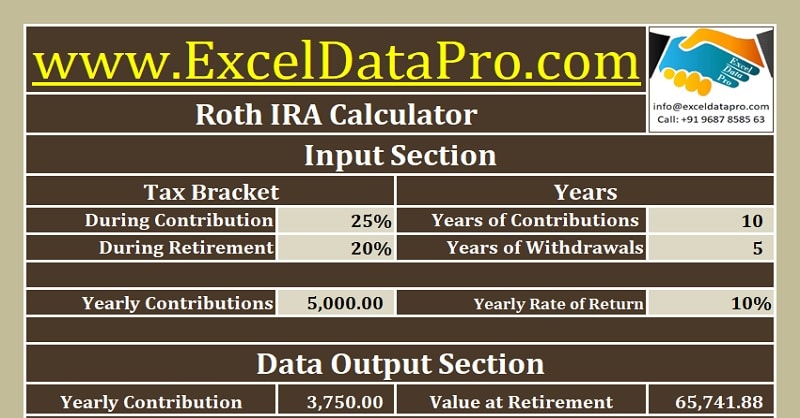

Download Roth Ira Calculator Excel Template Exceldatapro

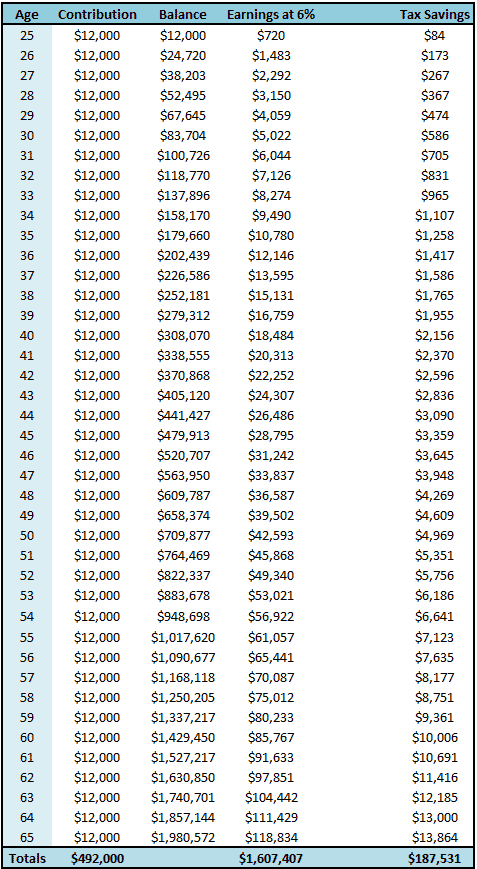

Calculating The Value Of Your Backdoor Roth Contributions Physician On Fire

The Optometrist S Guide To Roth Ira Chapter 1 Introduction And Backdoor Roth Ira Ods On Finance

Roth Ira Calculator Roth Ira Contribution

Calculating The Value Of Your Backdoor Roth Contributions Physician On Fire

Factors To Consider When Contemplating A Backdoor Roth Ira

Understanding The Mega Backdoor Roth Ira

Calculating The Value Of Your Backdoor Roth Contributions Physician On Fire